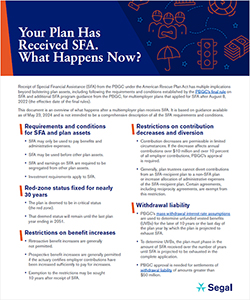

Receipt of Special Financial Assistance (SFA) from the PBGC under the American Rescue Plan Act has multiple implications beyond bolstering plan assets.

Plans must satisfy the requirements and conditions established by the PBGC’s final rule on SFA.

They must also follow additional SFA program guidance from the PBGC, for multiemployer plans that applied for SFA after August 8, 2022 (the effective date of the final rules).

We discussed the PBGC’s final rule in a July 7, 2022 insight, the PBGC's clarification of how SFA affects withdrawal liability in a December 21, 2023 insight and securing SFA assets in a webinar.

To help trustees of these plans, we’ve created an overview of what happens after the plans receive SFA.

Share this page

The overview covers these and other important topics:

Multiemployer Plans, Technology, Benefits Technology, ATC

Retirement, Multiemployer Plans

Retirement, Multiemployer Plans, Public Sector, Healthcare Industry, Higher Education, Architecture Engineering & Construction, Benefits Administration, Corporate, Benefits Technology, ATC, Technology

This page is for informational purposes only and does not constitute legal, tax or investment advice. You are encouraged to discuss the issues raised here with your legal, tax and other advisors before determining how the issues apply to your specific situations.

© 2025 by The Segal Group, Inc.Terms & Conditions Privacy Policy California Residents Sitemap Disclosure of Compensation Required Notices