Flood risk is real everywhere because flooding can happen anywhere.

That’s why all organizations need adequate flood insurance coverage, regardless of where their property is located.

Share this page

This article presents an overview of flood risk and outlines how to assess whether your organization has sufficient coverage to provide protection if your building(s) and the contents are damaged in a flood. It also discusses the value of having plans in place for business continuity and disaster recovery in the event of a flood (or any other major disruptive event) affecting your operations.

Most flood insurance claims come from what the National Flood Insurance Program calls Special Flood Hazard Areas, which have a high risk of flooding. However, more than 40 percent of claims in recent years have come from areas that have a moderate-to-low risk of flooding.

In fact, 99 percent of all U.S. counties have experienced a flood event since 1998, according to the Federal Emergency Management Agency (FEMA).

Hurricanes and tropical storms can lead to coastal flooding. During the 2024 Atlantic hurricane season there were 18 named storms, according to the National Oceanic and Atmospheric Administration (NOAA). Three led to major flood damage:

Moody’s RMS® estimates the losses related to these three hurricanes will likely range between $35 billion and $55 billion.

Heavy rains can also trigger flash flooding and levee or dam breaks. In January 2024 parts of San Diego were flooded following heavy rain. In June 2024, several states in the Midwest — Iowa, Minnesota and North Dakota — experienced catastrophic flooding after record rainfall of more than a foot in some areas. NOAA estimated that the losses totaled more than $1 billion. In February 2025, Kentucky experienced floods after several days of heavy rain.

Melting snow is another source of floods. In December 2024, some states in the Northeast — Connecticut, Massachusetts, New Hampshire, New York and Vermont — experienced heavy snowfall followed by rapid melting that led to flash-flood warnings in some areas.

There’s also a higher risk of flash flooding and mudflows in the aftermath of wildfires. Fortunately, the heavy rain that fell in the Los Angeles area after the wildfires began, did not trigger flash flooding or mudflows.

The nonprofit First Street Foundation and global engineering firm Arup looked at the risk of flood damage to 3.6 million retail, office and multi-unit residential properties across the U.S.

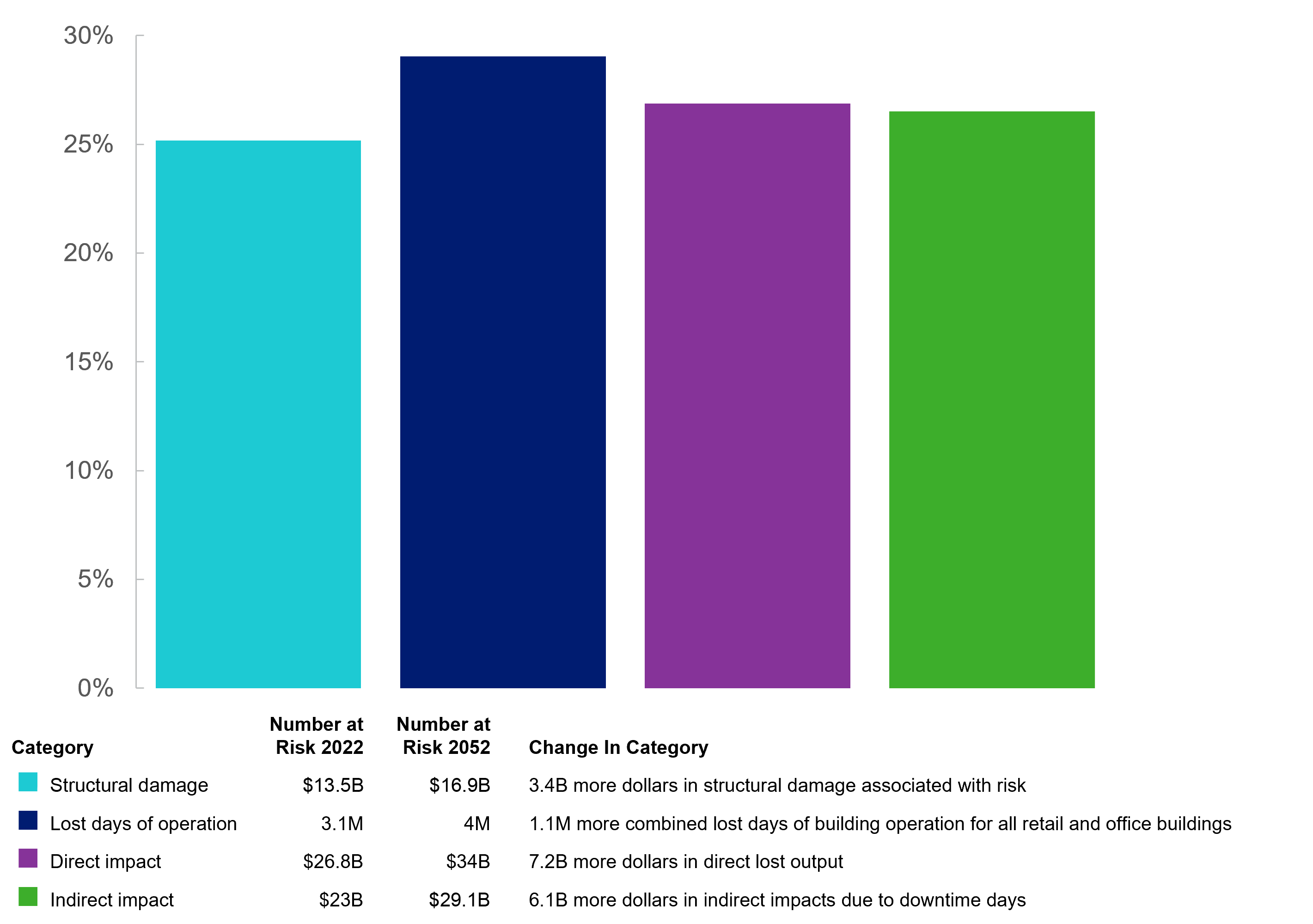

A key finding of their research, “The 4th National Risk Assessment: Climbing Commercial Closures,” was that U.S. businesses could face $16.9 billion in structural damage by 2052, as noted next to the key in the following graph. That would be an increase of roughly 25 percent over 2022 estimated flood-related spending.

Source: First Street Foundation, “The 4th National Risk Assessment: Climbing Commercial Closures” (December 13, 2021). Reprinted with permission.

NOAA publishes long-range flood risk estimates for three-month periods. NOAA is expected to issue its forecast for the 2025 Atlantic Hurricane season in May.

According to a 2022 article published in Nature Climate Change, flood risk is expected to rise in many counties over the coming decades, as the map below illustrates.

Source: Wing, O.E.J., Lehman, W., Bates, P.D. et al. Inequitable patterns of U.S. flood risk in the Anthropocene. Nat. Clim. Chang. 12, 156–162 (2022). https://www.nature.com/articles/s41558-021-01265-6

A flood doesn’t have to be severe to have a major impact on your organization.

Just a few inches of floodwater can cause tens of thousands of dollars in damage, according to FEMA.

It’s a good idea to review your commercial insurance coverages to verify if you are adequately protected in the event of a flood.

Commercial insurance coverages do not always include flood protection. Even if they do, in geographic areas that have a high flood risk, it may be prudent to purchase a stand-alone flood policy. If you have a mortgage, the lender can require flood insurance depending on your flood zone.

Segal offers a complimentary policy review to assess the appropriateness of your current property and casualty coverage and flood coverage.

As part of our review, we will:

As a leading broker for plan sponsors for decades, we have the experience to give you insights into coverage gaps and options for closing them.

Find out with a complimentary policy review.

Request One NowThe old saying “forewarned is forearmed” is particularly apt when considering flood risk and similar risks.

If your organization is affected by a flood, its ability to bounce back quickly increases if it already has plans in place to address disaster recovery and business continuity.

A disaster recovery plan is meant to help you protect, recover and restore critical IT systems and assets.

To ensure your plan has the essential elements, take these steps:

The Occupational Safety and Health Administration’s website has helpful information on flood preparedness and response, including common hazards and how to protect your recovery team.

A business continuity plan ensures employees and assets are able to perform essential business functions safely and with minimal downtime.

As part of your organization’s business continuity plan, be sure to:

Segal’s Administration and Technology Consulting Practice helps organizations develop comprehensive disaster recovery and business continuity plans that are tailored to their needs, so they can get back to business as soon as possible after a flood or other disaster.

Insurance, Technology, Cybersecurity Awareness Month, Cybersecurity consulting

Insurance, Cybersecurity consulting, Multiemployer Plans, Public Sector, Healthcare Industry, Higher Education, Architecture Engineering & Construction, ATC, Cyber Advisor, Cybersecurity Awareness Month, Risk Mitigation

Insurance, Multiemployer Plans, Public Sector, Higher Education, Healthcare Industry, Architecture Engineering & Construction, Corporate

This page is for informational purposes only and does not constitute legal, tax or investment advice. You are encouraged to discuss the issues raised here with your legal, tax and other advisors before determining how the issues apply to your specific situations.

© 2026 by The Segal Group, Inc.Terms & Conditions Privacy Policy Style Guide California Residents Sitemap Disclosure of Compensation Required Notices